Understanding a transport company’s financial health requires calculating net accounting value, a key indicator revealing asset worth after liabilities – a crucial concept․

The Unique Challenges of Transportation Accounting

Transportation accounting presents distinct hurdles compared to other industries․ Fluctuating fuel costs significantly impact profitability, demanding meticulous tracking and budgeting․ Complex regulations governing driver hours, vehicle maintenance, and safety necessitate diligent compliance reporting․

Mileage-based expenses and multi-state operations create intricate tax considerations․ Accurate allocation of costs between different freight types and routes is vital․ Managing a mobile workforce and associated payroll complexities adds another layer of difficulty․

Depreciation of vehicles, a major asset, requires careful method selection․ Inventory of parts and supplies must be efficiently managed․ Ultimately, mastering these challenges is key to sound financial management․

Importance of Accurate Record-Keeping in the Transport Sector

Precise record-keeping is paramount in transportation, directly influencing profitability and compliance․ Detailed expense tracking – fuel, maintenance, driver wages – enables informed cost control․ Accurate revenue recognition from freight services ensures proper financial reporting․

Maintaining a clear audit trail supports regulatory compliance and minimizes risk․ Effective inventory management of parts reduces downtime and optimizes costs․ Reliable financial statements facilitate informed decision-making for growth and investment․

Ultimately, robust records provide a true picture of the company’s financial health, enabling strategic planning and sustainable success within a competitive landscape․

Core Accounting Principles for Transportation Businesses

Fundamental accounting principles guide financial reporting, ensuring transparency and comparability for transport companies navigating complex regulations and operational costs effectively․

Accrual vs․ Cash Accounting Methods

Choosing between accrual and cash accounting significantly impacts a transportation company’s financial picture․ Cash accounting recognizes revenue when money is received, and expenses when paid, offering simplicity but potentially misrepresenting profitability․ Conversely, accrual accounting recognizes revenue when earned, and expenses when incurred, regardless of cash flow․

For transport businesses, accrual accounting provides a more accurate long-term view, aligning revenue with the services delivered and expenses with the resources consumed․ This method is generally preferred for larger companies and offers a clearer understanding of financial performance, especially when dealing with credit terms and deferred payments common in the industry․ While more complex, accrual accounting delivers a more realistic and comprehensive financial representation․

Generally Accepted Accounting Principles (GAAP) Compliance

Adhering to Generally Accepted Accounting Principles (GAAP) is paramount for transportation companies, ensuring financial statements are consistent, transparent, and comparable․ GAAP compliance builds trust with stakeholders – investors, lenders, and regulatory bodies – by providing a standardized framework for reporting financial information․

This includes proper revenue recognition, expense allocation, and asset valuation․ For transport firms, specific GAAP guidelines apply to areas like freight revenue, fuel costs, and vehicle depreciation․ Consistent application of GAAP facilitates accurate financial analysis and informed decision-making․ Non-compliance can lead to penalties, reputational damage, and difficulties securing funding․ Maintaining meticulous records and seeking professional guidance are crucial for successful GAAP adherence․

Chart of Accounts Specific to Transportation

A well-defined chart of accounts is vital, categorizing revenue, expenses, and assets unique to transport – freight, fuel, vehicles, and more․

Revenue Accounts (Freight, Mileage, Demurrage)

Freight revenue represents the core income stream, meticulously tracked by shipment details – origin, destination, weight, and associated rates․ Mileage-based revenue, common in certain transport arrangements, requires precise distance calculations and per-mile charges․

Demurrage revenue arises from delays exceeding agreed-upon free time at ports or terminals, generating income from storage or detention fees․ Accurate recording of these revenue streams necessitates detailed invoicing, proper classification, and consistent application of pricing policies․

Furthermore, accessorial charges – fuel surcharges, liftgate fees, or hazardous material handling – must be separately accounted for to provide a comprehensive view of revenue generation․ Consistent monitoring and reconciliation are essential for maximizing revenue recognition and ensuring financial accuracy․

Expense Accounts (Fuel, Maintenance, Driver Wages, Insurance)

Fuel expenses, a significant cost driver, demand diligent tracking of consumption, prices, and fuel tax compliance․ Vehicle maintenance, encompassing routine servicing and repairs, requires detailed records of parts, labor, and associated costs․

Driver wages, including salaries, benefits, and potential bonuses, must be accurately calculated and allocated․ Insurance expenses, covering liability, cargo, and physical damage, necessitate careful policy management and premium payments․

Effective expense management involves consistent categorization, detailed documentation, and regular analysis to identify cost-saving opportunities․ Proper allocation of expenses to specific routes or vehicles enhances profitability insights and informed decision-making․

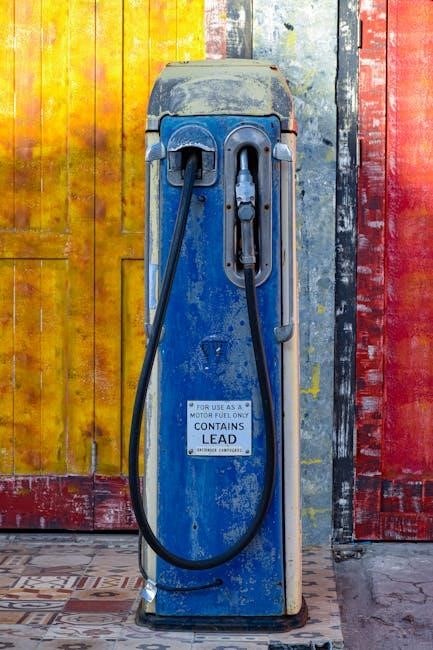

Asset Accounts (Vehicles, Equipment, Real Estate)

Vehicles represent a substantial investment, requiring meticulous tracking of purchase price, financing details, and accumulated depreciation․ Equipment, including trailers, dollies, and loading machinery, demands similar detailed record-keeping․

Real estate, such as terminals or warehouses, necessitates tracking acquisition costs, property taxes, and any related improvements․ Accurate asset valuation is crucial for financial reporting and assessing the company’s overall financial position․

Regular asset inventories and condition assessments are vital for maintaining accurate records and identifying potential impairments․ Proper asset management directly impacts the company’s balance sheet and long-term financial health․

Revenue Recognition in Transportation

Freight service revenue recognition hinges on fulfilling performance obligations, while fuel surcharges and accessorial charges require careful, separate accounting treatment․

Recognizing Revenue from Freight Services

Accurate revenue recognition for freight services is paramount, aligning with accounting standards․ This typically occurs when control of the goods transfers to the customer, often upon delivery at the destination․

However, complexities arise with multi-leg shipments or contracts with specific delivery terms․ Companies must carefully define performance obligations within each contract․ Revenue is then allocated to these obligations based on their relative standalone selling prices․

Proper documentation, including bills of lading and proof of delivery, is essential for supporting revenue recognition․ Consistent application of revenue recognition policies ensures financial statement reliability and comparability, vital for stakeholders’ informed decisions․

Handling Fuel Surcharges and Accessorial Charges

Fuel surcharges, fluctuating with market prices, require careful accounting treatment․ These are generally considered a component of revenue, not a separate expense, and are recognized alongside freight revenue․ Transparent documentation of the surcharge calculation method is crucial․

Accessorial charges – for services like lift gates, detention, or re-delivery – also impact revenue recognition․ These should be clearly itemized on invoices and recognized when the related service is performed․

Consistent application of policies for both fuel surcharges and accessorial charges is vital for accurate financial reporting․ Proper allocation and documentation ensure compliance and provide a clear picture of overall profitability․

Cost Accounting for Transportation Operations

Effective cost accounting differentiates between direct and indirect expenses, enabling precise calculation of operational costs per mile or kilometer for profitability analysis․

Direct vs․ Indirect Costs

Distinguishing between direct and indirect costs is fundamental to accurate transportation accounting․ Direct costs are those demonstrably tied to specific transportation activities; examples include fuel, driver wages (for driving time), and tolls directly associated with a particular haul․ These are easily traceable and allocated․

Indirect costs, conversely, support overall operations but aren’t directly linked to individual trips․ Examples encompass administrative salaries, insurance premiums for the fleet, depreciation on office equipment, and maintenance facility costs․ Allocating these requires a reasonable method, like mileage or revenue, to distribute them fairly across services․

Proper categorization ensures a clear understanding of profitability, allowing businesses to pinpoint areas for cost reduction and optimize pricing strategies․ Accurate cost allocation is vital for informed decision-making․

Calculating Cost Per Mile/Kilometer

Determining cost per mile (or kilometer) is a cornerstone of transportation accounting, providing a benchmark for profitability analysis and pricing decisions․ This calculation involves summing all direct and allocated indirect costs for a specific period – typically a month or year – and dividing that total by the total miles (or kilometers) driven during the same period․

Accurate tracking of mileage and comprehensive cost inclusion are crucial․ Factors to consider include fuel, driver wages, maintenance, insurance, and allocated overhead․ A lower cost per mile generally indicates greater efficiency․

Regularly monitoring this metric allows businesses to identify trends, assess the impact of operational changes, and ensure competitive pricing․

Depreciation of Transportation Assets

Depreciation reflects the decline in value of assets like vehicles over time, impacting profitability․ Methods such as straight-line or declining balance are commonly used․

Methods of Depreciation (Straight-Line, Declining Balance)

Depreciation methods significantly impact a transportation company’s financial statements․ The straight-line method allocates an equal depreciation expense each year over the asset’s useful life, offering simplicity and predictability․ Conversely, the declining balance method accelerates depreciation, recognizing higher expenses in the early years and lower expenses later on․

Choosing the appropriate method depends on the asset’s usage pattern and company preferences․ Accelerated methods better reflect the higher productivity of newer assets․ Accurate depreciation calculations are vital for determining net income and asset values, influencing tax liabilities and investment decisions․ Properly applying these methods ensures compliance and provides a realistic view of a company’s financial position․

Impact of Depreciation on Profitability

Depreciation directly affects a transportation company’s profitability by reducing the reported value of assets over time․ As a non-cash expense, it lowers net income without an immediate cash outflow․ Higher depreciation expenses in early years, as seen with declining balance methods, can initially decrease profits․

However, depreciation also provides tax benefits, reducing taxable income and lowering tax liabilities․ Accurate depreciation calculations are crucial for a realistic assessment of profitability and financial performance․ Understanding this impact is vital for investors and stakeholders evaluating the company’s financial health and long-term sustainability․ Effective management of depreciation strategies can optimize profitability and tax efficiency․

Inventory Management (Parts & Supplies)

Efficient tracking of parts and supplies costs is essential; utilizing methods like FIFO, LIFO, or weighted average impacts valuation and profitability․

Tracking Inventory Costs

Meticulous inventory cost tracking is paramount for transportation companies, extending beyond simply knowing quantities on hand․ It necessitates a detailed system to capture the cost of each part and supply, factoring in purchase price, freight, handling charges, and any applicable taxes․

This detailed cost accounting allows for accurate determination of the Cost of Goods Sold (COGS) when parts are used for maintenance and repairs․ Furthermore, consistent tracking enables better budgeting, forecasting, and identification of potential cost savings through supplier negotiations or bulk purchasing․

Implementing a robust inventory management system, potentially integrated with accounting software, is crucial for streamlining this process and minimizing errors․ Regular physical inventory counts should be conducted to reconcile records and ensure accuracy․

Inventory Valuation Methods (FIFO, LIFO, Weighted Average)

Selecting an appropriate inventory valuation method significantly impacts a transportation company’s reported profitability and tax liability․ First-In, First-Out (FIFO) assumes the oldest inventory items are sold first, often reflecting current costs․ Last-In, First-Out (LIFO), permitted in some jurisdictions, assumes the newest items are sold first, potentially lowering taxable income during inflation․

The Weighted Average method calculates a weighted average cost based on the total cost of goods available for sale divided by the total units available․ Each method yields different results, particularly during periods of fluctuating prices․

Consistency in applying the chosen method is vital for accurate financial reporting and comparability over time․ Careful consideration of tax implications and industry practices is essential when making this decision․

Accounts Payable and Accounts Receivable

Efficiently managing vendor payments and customer collections is crucial for maintaining healthy cash flow within a transportation business, ensuring operational stability․

Managing Vendor Payments

Effective vendor payment management is paramount for transportation companies, impacting both financial health and supplier relationships․ Establishing clear payment terms, utilizing invoice automation systems, and taking advantage of early payment discounts are vital strategies․

Regularly reconciling vendor statements against internal records ensures accuracy and prevents discrepancies․ A robust approval process for invoices minimizes errors and potential fraud․ Maintaining detailed records of all payments, including dates and amounts, is essential for audit trails and tax compliance․

Prioritizing payments based on due dates and potential penalties helps avoid late fees and maintains a positive credit standing․ Strong communication with vendors regarding payment schedules fosters trust and collaboration, ultimately streamlining the entire process․

Collecting Payments from Customers

Prompt and efficient collection of customer payments is critical for a transportation company’s cash flow․ Implementing a clear invoicing process with detailed service descriptions and accurate rates is the first step․ Offering diverse payment options – including online portals, credit cards, and electronic funds transfers – enhances convenience․

Establishing credit limits and consistently monitoring customer accounts minimizes the risk of bad debt․ Proactive follow-up on overdue invoices, coupled with clear communication regarding payment expectations, is essential․ Consider offering early payment incentives to encourage timely remittance․

Maintaining detailed records of all customer payments and applying them accurately to outstanding invoices ensures financial transparency and facilitates reconciliation․

Financial Statements for Transportation Companies

Key statements – Income, Balance Sheet, and Cash Flow – reveal profitability, assets/liabilities, and liquidity, providing a comprehensive view of the company’s financial position․

Income Statement (Profit & Loss)

The Income Statement, often called the Profit & Loss (P&L) statement, summarizes a transportation company’s financial performance over a specific period․ It begins with total revenue generated from freight services, mileage, and any accessorial charges․

Next, the statement meticulously deducts all associated costs – fuel, driver wages, maintenance, insurance, and depreciation of assets․ This process reveals the gross profit, then subtracts operating expenses to arrive at the operating income․

Finally, accounting for interest, taxes, and other non-operating items leads to the net income, representing the company’s overall profitability․ Analyzing trends in revenue and expenses is vital for informed decision-making․

Balance Sheet

The Balance Sheet presents a snapshot of a transportation company’s assets, liabilities, and equity at a specific point in time․ Assets, including vehicles, equipment, and cash, represent what the company owns․ Liabilities, such as accounts payable and loans, detail what the company owes to others․

Equity represents the owners’ stake in the company․ The fundamental accounting equation – Assets = Liabilities + Equity – must always balance․ Analyzing the balance sheet reveals the company’s financial position, liquidity, and solvency․

Key ratios derived from the balance sheet, like debt-to-equity, provide insights into financial risk and stability, crucial for assessing long-term viability․

Cash Flow Statement

The Cash Flow Statement tracks the movement of cash both into and out of a transportation company over a specific period․ It categorizes cash flows into three activities: operating, investing, and financing․ Operating activities reflect cash generated from core business functions, like freight services․

Investing activities involve purchases and sales of long-term assets, such as vehicles․ Financing activities relate to debt, equity, and dividends․ A positive cash flow indicates the company generates more cash than it spends․

Analyzing this statement is vital for assessing liquidity, solvency, and the ability to fund future growth, offering a clearer picture than profit alone․

No Responses